Imagine gliding through traffic while your car documents not only you but also each of your journeys - effortlessly, precisely and without the hassle of paperwork. Keeping an electronic logbook is not just a practical tool, it's your smart co-pilot on the road. Find out everything you need to know about this practical program here.

What is an electronic logbook?

It is important for companies to keep a logbook as it records a lot of important information for tax purposes. Electronic logbooks in particular are on trend. They are easier to use than the old handwritten versions, environmentally friendly and extremely robust. Once the data is in the cloud, it is never lost. An electronic logbook records your journeys by date, time and distance travelled. You can easily distinguish between business and private journeys. Thanks to GPS trackers, all routes are recorded automatically so that the app can tell you directly what the journey was for. The best thing about it? Most systems work automatically: your car simply connects to your smartphone as soon as you set off. This makes keeping a logbook a real breeze.

What are the advantages of electronic logbooks?

Electronic logbooks are the modern solution to the traditional paper logbook and offer a much more precise way to record your journeys. With a digital logbook method, relevant information such as date, time, mileage and destination are recorded automatically. This not only saves time, but also eliminates the need for tedious manual recording. You can rely entirely on automatic documentation, which reduces the effort and at the same time reduces the error rate that is more common with handwritten records.

Another big advantage is the tax relief. With an electronic logbook, companies can avoid the 1% rule and instead document the actual journeys. This can lead to significant tax savings, which is particularly beneficial for company cars. In addition, most electronic logbooks allow you to analyze the journeys. If you keep an eye on your speed, acceleration and braking habits, you can adjust your driving behavior and thus be more environmentally friendly. Driving more gently not only helps to reduce fuel consumption, but also allows you to save a lot of money. In addition, the integrated GPS trackers not only offer accurate route tracking, but also provide valuable information on road safety. This not only makes driving easier, but also significantly safer.

Three types of electronic logbooks

Basically, a distinction is made between three types of trip recording:

- Navigation systems with integrated logbook : In this variant, the logbook is already integrated into the vehicle's navigation system, so no additional hardware is required. This solution is often offered by premium car manufacturers, but some navigation system providers also offer products that include this function.

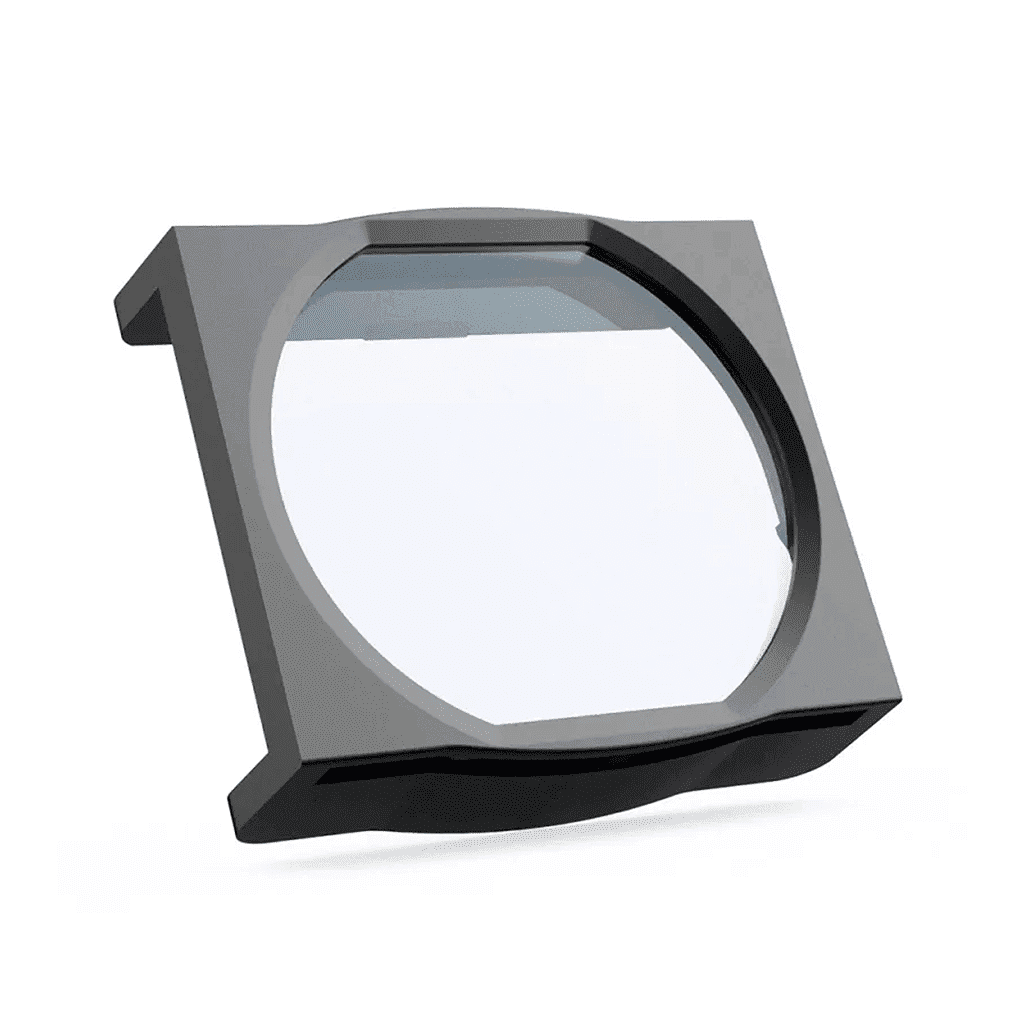

- Combination of software and hardware : This involves installing special hardware in the vehicle, for example in the form of a plug that records the vehicle data using on-board diagnostics (OBD). The data collected is then managed by software. This solution is particularly practical if employees do not have company cell phones, as they do not have to install an additional app on their private device.

- Pure software : Here you buy software that records and saves the required data. It is usually installed on a smartphone. Many providers also provide a logbook app that enables mobile use. Drivers can then access the service via the Internet, which documents the necessary information and saves the logbook online via cloud synchronization. The data can then be easily transferred to a PC for further processing.

Is an electronic logbook accepted by the tax office?

In Germany, bureaucracy is unfortunately an integral part of everyday life, and this also applies to the recognition of electronic logbooks by the tax office. In order for an electronic logbook to be recognized, certain requirements must be met. These include the complete and gapless documentation of required information such as mileage at the start and end of the journey, destination and purpose of the trip. It is also advisable to use the comment function to provide additional explanations that make the information more understandable.

For example, if you take a detour on the way to a customer because of a traffic jam, you should briefly note the reason for this detour to avoid misunderstandings.

It is also important to state the business partner or customer in the purpose of the trip so that the tax office can better understand the journey. This information must be recorded "in a timely manner" because some tax offices do not recognize electronic logbooks, which only record the kilometers but do not document the reason for the journey.